Remerge and Fyber discuss app marketing trends for 2022

January 31, 2022

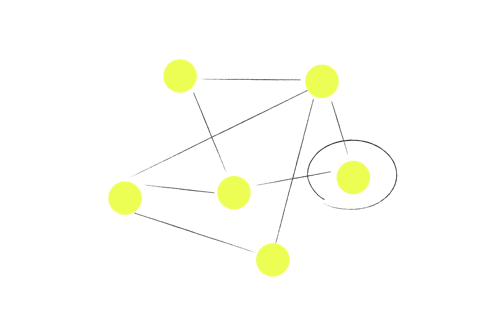

The impact of the App Tracking Transparency (ATT) framework has almost reached its ceiling, with the global adoption rate for iOS 14.5+ now at over 82 percent. The number of iOS bid requests for identifiable users has decreased since Apple’s privacy changes took effect but as of November 2021, the volume of IDFA inventory still accounts for over 50 percent of the programmatic market. This amount is higher than many experts initially anticipated and enough for app marketers to advertise at scale on ID-based traffic.

A considerable portion of app marketers is still figuring out the best way to run iOS campaigns with SKAdNetwork. Meanwhile, others have shifted budgets to invest more heavily in Android and several players are turning to incrementality measurement to gain performance insights on no-ID traffic.

In the third part of our ID or No ID content series, we asked Güven Soydan, VP Product at Remerge, and Yoni Markovizky, GM Marketplace at Fyber, for their thoughts on what's happening in the programmatic advertising industry as we head into 2022.

Download the full version of the report to access all the insights.

Android and iOS traffic with ID has become the battlefield

Güven Soydan, VP Product, Remerge

Güven, what are your overall thoughts on the industry post-ATT?

What’s interesting to me is that the players who have been the most vocal and proactive in embracing the privacy changes and implementing technologies that Apple has provided have not been the ones that have seen all of this as an opportunity.

There have been short-term rewards for those that have interpreted the policies as mere suggestions and did not rush into adopting them. Apple, for instance, stated that there would be absolutely no fingerprinting — yet 8 months into the “new world”, SKAdNetwork continues to be the least preferred way of running user acquisition campaigns on no-ID traffic. This is not surprising as SKAdNetwork is just very different from what marketers are used to. To make data-based decisions in the short term, industry players will get whatever they can, be it numbers that make sense or numbers that are connected to some form of data structure. The confusion that surrounds the inability to easily create “human-data-insights-machine systems” with SKAdNetwork data has pushed the industry to keep using what works — until it doesn’t (if that day ever comes).

On the other hand, technology teams still want to know the true value of an impression, and ID traffic on Android and iOS has become the battlefield. The competition is fierce for traffic that can be measured and optimized.

Across the board, we have seen companies focus on building out their creative technologies to better scale and optimize their campaigns (since powerful creatives will always bring benefits, regardless of user identities). And, of course, many have begun to work on contextual signals, an “old school” optimization strategy.

« App marketers must look at what they can do with the available traffic to provide value for their customers. »

Güven Soydan, VP Product, Remerge

What does this mean for marketers running retargeting campaigns?

Our post-IDFA dashboard shows that more than half of iOS inventory still has an IDFA. The bad news here is it might mean that even fewer customers are available to marketers, as the overlap of the people who have given consent in their apps may not be the same people we see on our internal dashboards. Therefore, app marketers planning a re-engagement strategy must find partners that can get as close as possible to covering all types of audiences out there. With the capability of processing 3.3 billion queries per second, I would say Remerge is perfectly positioned to be that partner.

App marketers must look at what they can do with the available traffic to provide value for their customers. They should spend some of their budget on increasing their footprint in the competitive marketplace while optimizing ruthlessly. The optimization decisions that didn’t matter back in the day (because of the abundance of available inventory) are now essential. This includes the personalized treatment of users, starting from the moment of impression all the way to the checkout. The customer-obsessed approach to advertising will be the new game.

What's the biggest challenge for advertisers at the moment?

While advertisers continue grabbing on to what they can understand and change, such as fingerprinting and contextual optimization, the biggest challenge within the programmatic space will be comparing results and using the analysis to make budget allocation decisions and set the right goals.

Although SKAdNetwork seems to be a reliable framework for measuring a fraction of what was possible, programmatic partners that do not have the SDK footprint of players such as Google and Facebook will not be able to measure their own impact.

The consolidation of partners that advertisers work with is inevitable. Not because of the operational benefits this brings, but because it provides more reliable measurement. This is especially true for methodologies such as Causal Impact, which benefit from more data per partner. I would love to see the prevalence of scientific and transparent approaches that create and nurture trust between partners. Advertisers that demand trust should succeed in the long run.

However, with the millions of moving pieces and mechanics that drive the market, we can only wait and see if it’s logical decisions or the aggressive tactics of market leaders that define the future of the industry.

Privacy is a bigger priority than ever before

Yoni Markovizky, GM Marketplace Fyber, A Digital Turbine Company

Yoni, what's your take on the state of programmatic right now?

One thing is certain: our industry expected a catastrophe, but that didn’t happen. Predictions ranged from a complete crash of some segments to a more conservative dip-followed-by-recovery — but it is evident now that many players were smart, well prepared, and quick to adjust, which enabled a smoother transition.

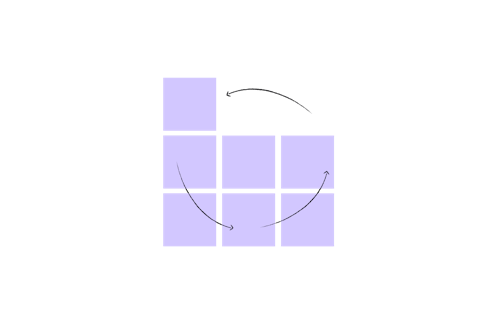

In approximately three to four months, app publishers tested and learned. They looked at challenges on the user acquisition (UA) front and went to the channels that work better post-IDFA. They rethought their monetization strategies — from picking the right vendors to setting up their waterfall and auctions optimally — and tested until they reached the strategies that work for them.

Moreover, there was a minor dip, and then an uptake. Fyber recorded similar results post-IDFA for publishers and in some cases, we delivered stronger results. The industry is strong and mobile advertising remains on the rise. The way we’ve dealt with the changes says a lot about the resilience of industry players, as well as their willingness to adapt to the new privacy era mobile users demanded.

Privacy is a bigger priority than ever for consumers, and the direction is clear. Apple made a significant step and the industry is following. Google’s announcement of steps towards further restrictions of developer access to the Google Advertising ID (GAID), as well as additional privacy-aware policies likely to be rolled out in 2022, is yet another confirmation of this direction.

« If you want to win on iOS, you have to know how to work with users who don’t share their IDFA. »

Yoni Markovizky, GM Marketplace, Fyber

What impact does this have for iOS?

If you want to win on iOS, you have to know how to work with users who don’t share their IDFA. A strategy that relies on users who do is not scalable. The top DSPs that buy iOS on our platform at scale are those who achieve higher ROAS and conversions without having to rely on IDFAs.

The 50 percent of inventory on iOS that still has IDFA doesn’t give us the full picture. In reality, while some users choose to share their IDFA with certain apps, it’s not always enough when running effective targeting campaigns on iOS. Even if a user downloads an app after seeing an ad, that same user has to give consent to the new app they downloaded — there has to be a double opt-in move to enable effective targeting and attribution. So even if one out of two users gives the opt-in after downloading the app, it’s still 25 percent, not 50 percent. And the actual numbers are lower; the US overall is currently at a 30 percent opt-in rate and other countries are lower, so the probability of having a double opt-in is effectively under 15 percent.

What market developments do you expect to see?

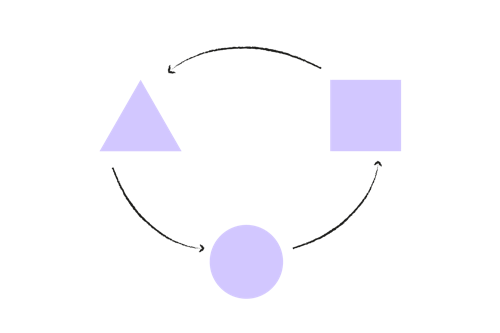

Consolidation will enable cross-promotion at scale. I expect privacy changes to drive even more consolidation in our market, among other causes. Companies that understand the importance of cross-promotion, where attribution is still possible, will be in the new privacy reality and will strive to consolidate with other parts of the value chain. They understand how this works and will look to scale up these campaigns under their umbrella.

What else will be important in 2022?

As individual user data isn’t available anymore, audience segmentation will become useful for advertisers. This will require smart, extensive data work that looks at first-party data and the utilization of contextual targeting strategies. Advertisers can use contextual signals such as CTR and video completion to inform bid requests and only pay more for users who are likely to pay from a session.

Globally, users want more privacy, and their mobile is one of the main arenas for this discussion. Since the ATT rollout, we have learned that adapting to current solutions, testing more than ever before, and innovating are the keys to success in mobile marketing.

More insights from Remerge and Fyber

Access the full analysis by downloading the third edition of the ID or No ID series.